Depreciation On Furniture And Fixtures Rate . Age specific (including cots, changing tables, floor sleeping. Web furniture used by children, freestanding: Web depreciation under the companies act, 1956 is different from that of income tax act. Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Web the depreciation rate of furniture can be influenced by several factors including the type of material (e.g., wood,. Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value.

from studylib.net

Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Web the depreciation rate of furniture can be influenced by several factors including the type of material (e.g., wood,. Web furniture used by children, freestanding: Age specific (including cots, changing tables, floor sleeping. Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Web depreciation under the companies act, 1956 is different from that of income tax act.

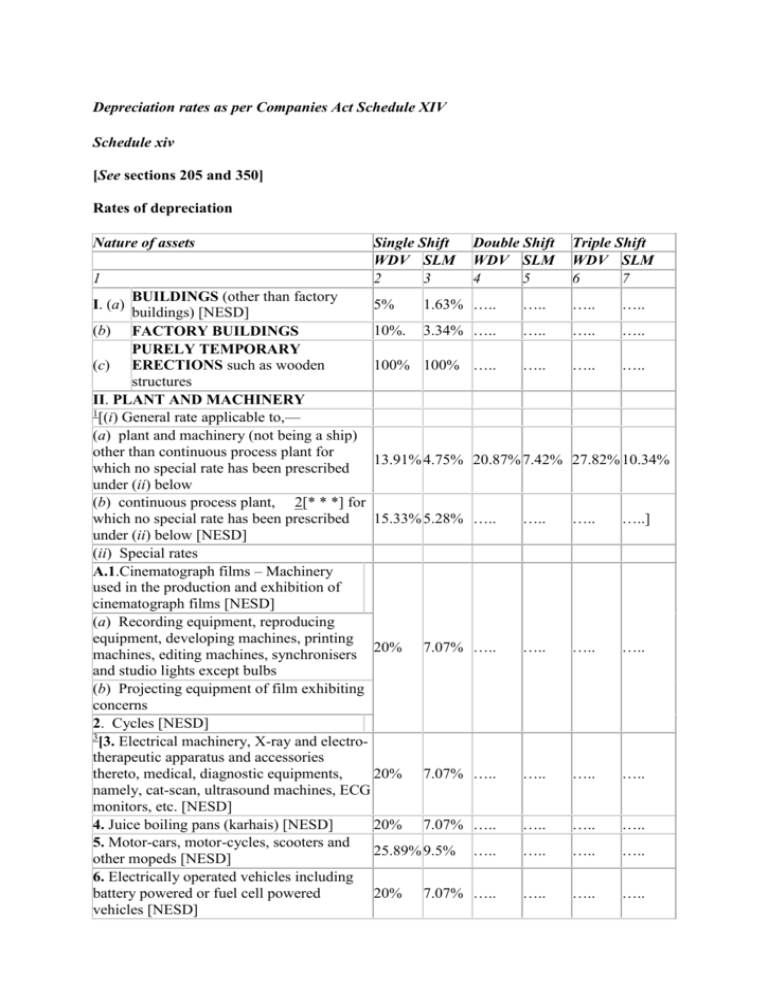

Depreciation Rates

Depreciation On Furniture And Fixtures Rate Web furniture used by children, freestanding: Web the depreciation rate of furniture can be influenced by several factors including the type of material (e.g., wood,. Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Web depreciation under the companies act, 1956 is different from that of income tax act. Age specific (including cots, changing tables, floor sleeping. Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Web furniture used by children, freestanding:

From www.wallstreetprep.com

What is Accumulated Depreciation? Formula + Calculator Depreciation On Furniture And Fixtures Rate Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Web the depreciation rate of furniture can be influenced by several factors including the type of material (e.g., wood,. Web furniture used by children, freestanding: Web depreciation. Depreciation On Furniture And Fixtures Rate.

From studylib.net

Depreciation Rates Depreciation On Furniture And Fixtures Rate Web depreciation under the companies act, 1956 is different from that of income tax act. Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Web the depreciation rate of furniture can be influenced by several factors including the type of material (e.g., wood,. Web the depreciation rate of furniture and. Depreciation On Furniture And Fixtures Rate.

From go-green-racing.com

Furniture And Fixtures Depreciation online information Depreciation On Furniture And Fixtures Rate Web furniture used by children, freestanding: Web depreciation under the companies act, 1956 is different from that of income tax act. Age specific (including cots, changing tables, floor sleeping. Web the depreciation rate of furniture can be influenced by several factors including the type of material (e.g., wood,. Web depreciable amount is the cost of an asset, or other amount. Depreciation On Furniture And Fixtures Rate.

From www.bmtqs.com.au

Fixtures & Fittings Depreciation Rate BMT Insider Depreciation On Furniture And Fixtures Rate Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Web furniture used by children, freestanding: Web depreciation under the companies act, 1956 is different from that of income tax act. Age specific (including cots, changing tables, floor sleeping. Web the depreciation rate of furniture and fixtures has changed to 10%. Depreciation On Furniture And Fixtures Rate.

From www.coursehero.com

[Solved] . LO5, 6 1642. Estimating Useful Life, Percent Used Up, and Depreciation On Furniture And Fixtures Rate Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Age specific (including cots, changing tables, floor sleeping. Web depreciation under the companies act, 1956 is different from that of income tax act. Web the depreciation rate of furniture can be influenced by several factors including the type of material (e.g., wood,. Web furniture used by. Depreciation On Furniture And Fixtures Rate.

From www.numerade.com

SOLVED CRUZ, INCORPORATED Comparative Balance Sheets 2021 At December Depreciation On Furniture And Fixtures Rate Age specific (including cots, changing tables, floor sleeping. Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Web furniture used by children, freestanding: Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Web depreciation under the companies act, 1956 is different from that of income. Depreciation On Furniture And Fixtures Rate.

From www.alerttax.in

Depreciation Rates Chart under Companies Act 2013 Depreciation On Furniture And Fixtures Rate Web the depreciation rate of furniture can be influenced by several factors including the type of material (e.g., wood,. Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Web furniture used by children, freestanding: Web depreciation under the companies act, 1956 is different from that of income tax act. Web depreciable amount is the cost. Depreciation On Furniture And Fixtures Rate.

From westcoastbookie.com

Furniture, Fixtures, and Equipment FF&E Definition Depreciation rates Depreciation On Furniture And Fixtures Rate Age specific (including cots, changing tables, floor sleeping. Web depreciation under the companies act, 1956 is different from that of income tax act. Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Web furniture used by. Depreciation On Furniture And Fixtures Rate.

From kitchenequipmenthankasa.blogspot.com

Kitchen Equipment Kitchen Equipment Depreciation Life Depreciation On Furniture And Fixtures Rate Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Web depreciation under the companies act, 1956 is different from that of income tax act. Web the depreciation rate of furniture can be influenced by several factors. Depreciation On Furniture And Fixtures Rate.

From www.indiafilings.com

Depreciation Rate for Furniture, Plant & Machinery IndiaFilings Depreciation On Furniture And Fixtures Rate Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Web the depreciation rate of furniture can be influenced by several factors including the type of material (e.g., wood,. Age specific (including cots, changing tables, floor sleeping. Web furniture used by children, freestanding: Web depreciation under the companies act, 1956 is. Depreciation On Furniture And Fixtures Rate.

From www.chegg.com

Solved Problem 1439 (LO. 1, 3, 4) Kantner, Inc., is a Depreciation On Furniture And Fixtures Rate Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Web depreciation under the companies act, 1956 is different from that of income tax act. Web furniture used by children, freestanding: Web the depreciation rate of furniture. Depreciation On Furniture And Fixtures Rate.

From athletedesk.com

What is the Depreciation Rate of Furniture? Athlete Desk Depreciation On Furniture And Fixtures Rate Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Web depreciation under the companies act, 1956 is different from that of income tax act. Web the depreciation rate of furniture can be influenced by several factors. Depreciation On Furniture And Fixtures Rate.

From www.educba.com

How Accumulated Depreciation Works? Formula & Excel Examples Depreciation On Furniture And Fixtures Rate Age specific (including cots, changing tables, floor sleeping. Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Web depreciation under the companies act, 1956 is different from that of income tax act. Web the depreciation rate. Depreciation On Furniture And Fixtures Rate.

From lloydkeelin.blogspot.com

Calculate depreciation of furniture LloydKeelin Depreciation On Furniture And Fixtures Rate Web the depreciation rate of furniture can be influenced by several factors including the type of material (e.g., wood,. Web depreciation under the companies act, 1956 is different from that of income tax act. Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Age specific (including cots, changing tables, floor sleeping. Web depreciable amount is. Depreciation On Furniture And Fixtures Rate.

From mungfali.com

Depreciation Rate Depreciation On Furniture And Fixtures Rate Age specific (including cots, changing tables, floor sleeping. Web depreciation under the companies act, 1956 is different from that of income tax act. Web furniture used by children, freestanding: Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its. Depreciation On Furniture And Fixtures Rate.

From maryrbequettexo.blob.core.windows.net

What Is The Depreciation Rate On Furniture Depreciation On Furniture And Fixtures Rate Web the depreciation rate of furniture can be influenced by several factors including the type of material (e.g., wood,. Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Age specific (including cots, changing tables, floor sleeping. Web furniture used by children, freestanding: Web the depreciation rate of furniture and fixtures. Depreciation On Furniture And Fixtures Rate.

From www.slideteam.net

Depreciation Furniture Fixtures Ppt Powerpoint Presentation Pictures Depreciation On Furniture And Fixtures Rate Web the depreciation rate of furniture and fixtures has changed to 10% from 15%. Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Web depreciation under the companies act, 1956 is different from that of income tax act. Web furniture used by children, freestanding: Age specific (including cots, changing tables,. Depreciation On Furniture And Fixtures Rate.

From grandpaperwriters.com

Question & Answer Prepare the balance sheet/SOFP as at 31 December Depreciation On Furniture And Fixtures Rate Age specific (including cots, changing tables, floor sleeping. Web depreciation under the companies act, 1956 is different from that of income tax act. Web depreciable amount is the cost of an asset, or other amount substituted for cost, less its residual value. Web furniture used by children, freestanding: Web the depreciation rate of furniture can be influenced by several factors. Depreciation On Furniture And Fixtures Rate.